NS Retail (AH to go)

Since 2021, NS AH to go has been conducting customer experience research with Secret View. NS (Dutch Railways) is the biggest franchiser of AH to go. Every week, all 47 locations at Dutch train stations are visited by Secret View's mystery shoppers.

Maarten van Ammers is the Business Manager of NS AH to go and oversees all 47 locations. In this article, you’ll learn how NS AH to go uses mystery shoppers, why they opt for weekly visits, and how the research has a positive impact on their organization and employees.

Company: NS Retail (AH to go)

Industry: Supermarket

Locations: 47 at train stations throughout the Netherlands

Client since: 2021

Spoken with: Maarten van Ammers, Business Manager AH to go at NS Retail

Why did NS AH to go choose Secret View for mystery shopping?

Before working with Secret View's mystery shoppers, we had employed freelancers. This same group would visit our locations once a month as mystery guests. But after a while, our employees started recognizing them, and the effect was diminished. It was also demotivating for the teams in the stores, as it created a sense of control.Julia’s and Kiosk, other NS retail concepts, were already working with Secret View and noticed a positive effect on their organizations. Our goal is to obtain an in depth realistic view of our stores, and mystery shopping is the perfect tool for that. By working with real customers and visiting all locations weekly, we have an accurate view of all our stores. Additionally, Secret View's dashboard is user-friendly and efficient.

Due to the high frequency of visits with weekly research, a continuous dialogue is established between the store managers and employees. This makes customer experience a tangible aspect on the shop floor and ingrains it in the minds of the employees. The weekly visits ensure that people stay alert and maintain their focus on customer experience. It gives them the opportunity to improve every week. As a manager, it provides me with a clear overview of the bigger picture and the trends.

How is the mystery shopping research structured?

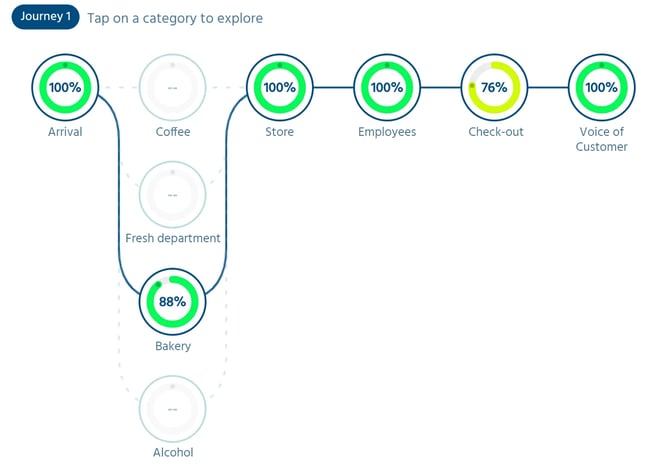

We have four different customer journeys: Coffee, Alcohol, Fresh Produce, and Bakery. We use 80% of the same questionnaire for each journey, while 20% varies depending on the specific customer journey. 80% of the questions are repeated weekly, and the remaining 20% is revisited every four weeks. This allows us to adjust our focus on different aspects throughout the year. For example, during summer, we pay closer attention to the Fresh produce category and align our targets accordingly.

The results of our mystery shopping research are an integral part of daily adjustments on the shop floor. With weekly visits from mystery guests, we get a realistic view of the store and the team. Each quarter, a store manager has a target consisting of five KPIs, and the mystery shopping research is one of those components, along with factors like revenue and loss prevention.

To keep everyone involved in the research, store managers can provide input on the questionnaire and weighting every six months. We incorporate their feedback in the evaluation with Secret View, and together we discuss the changes to be implemented. For me, it is important to keep the research accessible and relevant, focusing on the key aspects of the customer journey. It should not be an endless questionnaire. Just like a real customer, a mystery shopper should be able to leave the store within a few minutes.

How do you handle the results internally at different levels?

I receive all the results, and I review them all. Personally, I focus on the bigger picture and the trends provided by the dashboard. If a location stands out for an extended period, I address it. Furthermore, I discuss the results every six months during progress meetings with the district managers.

At every level of the organization, the results are used differently. District managers and store managers thoroughly analyze the questionnaires from A to Z. All the answers and scores are reviewed and discussed in various meetings. The result of the mystery shopping research is also one of the five KPIs by which they are evaluated. They discuss it with the store manager every week. Naturally, the store manager must follow it every week and ensure that the store personnel are informed. This can sometimes be a challenge, especially with young employees and high turnover. At the largest NS AH to go, there are about 100 employees, while the average team size is around 25 to 35 people. It's easier to involve everyone in the results in a smaller team than in a very large team.

It is particularly important that people in the organization do not perceive mystery shopping research as a means of control. We ensure that ourselves and maintain a positive atmosphere around it. We also have a rotating trophy that goes to the best-performing store every quarter. It became a bit of a thing for stores to keep the trophy in their possession for as long as possible. This creates competition between stores and districts, which is enjoyable to see. If a store scores poorly once, it's not a big deal. The only exception to this is alcohol, which we pay special attention to as it carries significant weight in the results.

Due to each store receiving 52 mystery shoppers per year, we can truly identify trends. The mystery shopping results are no longer just snapshots. The average score is ultimately what matters. Sometimes a mystery shopper does indeed have a negative experience, or someone disagrees with a mystery shopper. That sometimes happens with real customers too.

How does NS AH to go use the dashboard?

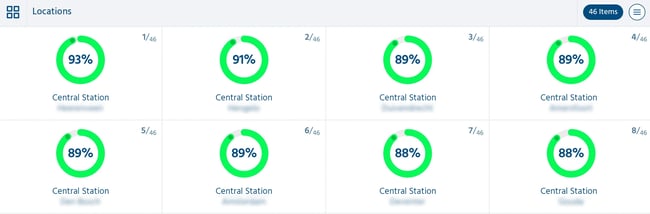

The dashboard is very user-friendly and clear. I always have all the results readily available on my phone. You can see all the rounds and stores, and the scores are easily discernible due to the use of colors. You can quickly switch from a helicopter view to a specific answer for a particular store. I find this flexibility and combination of management overview and details to be truly valuable.

In the organization, everyone has access to all the data on the dashboard. So, all the store managers can see all the results, not just from their own store but also from their colleagues' stores. We do notice that they mainly focus on their own store, but it also provides inspiration and fosters healthy competition among them.

One detail I appreciate is that you always see the best-performing stores, while the stores at the bottom are not immediately visible. This keeps the focus on the positive aspects. Additionally, we export the results and analyze trends every six months.

What effect does the mystery shopping research have on the organization?

We have been doing it this way for several years, and we have truly seen improvements. Our bakery has improved significantly, and the weekly research greatly contributes to that. The average score across the stores has also increased. Things move quickly in our stores, as people only spend a few minutes inside, since they are travelling. A shelf that you just restocked can be empty again in no time. Through mystery shopping and the importance we attach to it, we ensure that the personnel on the floor is focused on the right things. They know exactly what to pay attention to in order to enhance the customer experience.

Curious about what mystery shopping research can do for you?

We have years of experience in various industries with mystery shopping research. This way, we map customer experience for restaurants, supermarkets, clothing stores, and other sectors. Take a look at our cases or get in touch for a demo.